Bear Market: What You Do Will Make or Break Your Financial Advisor Career

Every advisor gets just a few great career-building opportunities: Times when they can really establish themselves as experts, build long-term credibility, and differentiate themselves from the competition – most of whom are hiding from their clients because they don’t know how to guide them through the bear market.

Every advisor gets just a few great career-building opportunities: Times when they can really establish themselves as experts, build long-term credibility, and differentiate themselves from the competition – most of whom are hiding from their clients because they don’t know how to guide them through the bear market.

What do the real pros do when things are scariest? When your clients are calling you scared witless, and they want to go to cash?

Well, they communicate, they reassure, and they give their clients a sense of market history, and direct their attention to the big picture.

They show clients how to think strategically and not just tactically.

And so should you!

And when you think of a bear market that way, and help your clients think of it that way, it becomes clear that the opportunity lies in the bear markets. The bull market is just the payoff.

Remember: We’ve been here before.

In August of 1979, BusinessWeek magazine actually printed a cover story in their magazine entitled “The Death of Equities.” They’ve been trying to live it down ever since.

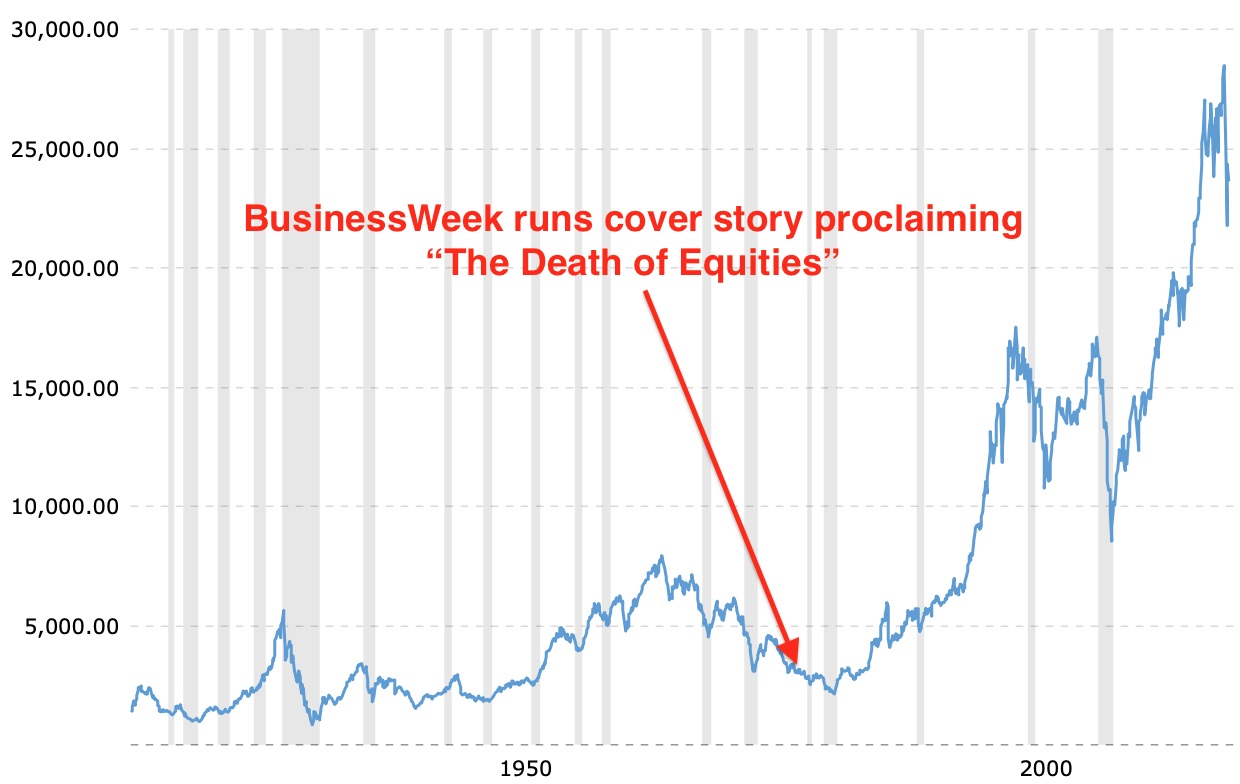

At the time it was published, the Dow Jones Industrial Average was under 3,000. Here we are, well into a devastating bear market. As of this writing, the Dow is at 23,685.42.

Well, we older folks have been here before. Many times.

This Coronavirus bear market was the seventh of my career. I became an advisor just after the Nifty Fifty era of stock market investing, before the 70s took over and crushed half the value out of equities.

Then the Carter recession of 1979. Then the Reagan/Volker recession of 1981. Black Monday, October 1987, when the S&P fell 22% in a single day. The Internet Bubble crash of 2000. Then the post-9/11 crash. The mortgage crisis. And let me tell you something the previous six all had in common:

- The seeds of the bear market were all sown at the height of the previous bull market.

- People got greedy, caught up in the euphoria, and thought nothing could go wrong.

- People were panic-selling or they had given up on the stock market. At the market bottom, people were overcome by despair and thought nothing would ever go right.

- All six of them were great buying

A bear market is commonly defined as a decline of 20% or more. By that measure, this is actually the 26th bear market we’ve seen since 1929. And 25 of them so far have had all those things in common!

This one isn’t going to be any different.

This isn’t even our first bear market due to a pandemic. We’ve had several of them before. And they’ve all ended up with stocks well into positive territory a year later.

Teach your clients to ignore the consumer financial media.

Here’s another chart I like to use to give people some perspective: The historical performance of the Dow Jones Industrial Average:

The red arrow indicates the date BusinessWeek proclaimed the “death of equities.”

Most other people felt the same way at that time. The financial media sure did.

Was it a good idea to believe what the consumer financial media was telling you at the time?

Was it even a close call?

No, and no!

Rationality beats emotion

See, it’s easy to say, “buy low and sell high.”

But actually doing that when you’re scared to death of losing money is a very difficult thing. People are driven by emotion and fear. Our job as advisors is to help counter that emotion by showing our clients the big picture, and bring everything into perspective.

Here are some of the things I tell my own clients:

Buy what’s on sale. America is the greatest country on earth, and we have the most resilient economy on the planet, with some of the best business leaders the world has ever seen, right now. We have the best workers in the world working with the best technology the world has ever seen, which makes our work force the most productive the world has ever seen.

When stocks are down, all that means is that shares in the best companies in the world are on sale! It’s like your local market is selling everything in the store at 25% off. You’d be crazy not to stock up your pantry!

Does that mean the market won’t be selling your favorite groceries at 30% off tomorrow? No! But it does mean you are getting a great value for your money – because you’re buying quality at a discount.

Warren Buffett has a great quote: He said he never knows just when the market bottom is. But he sure knows when stocks are a bargain – selling below their intrinsic value.

Smart investors don’t wait for ‘pullbacks’ that may never come. They pull the trigger when stocks are a bargain.

They don’t’ try to call market bottoms, because no one alive can perceive them except in hindsight. For investors, a market bottom isn’t a number. It’s a general recognition that the worst is over. But buy when stocks are more than worth the price, and you can do very well, over the long term.

“Fear is the Mind-Killer.”

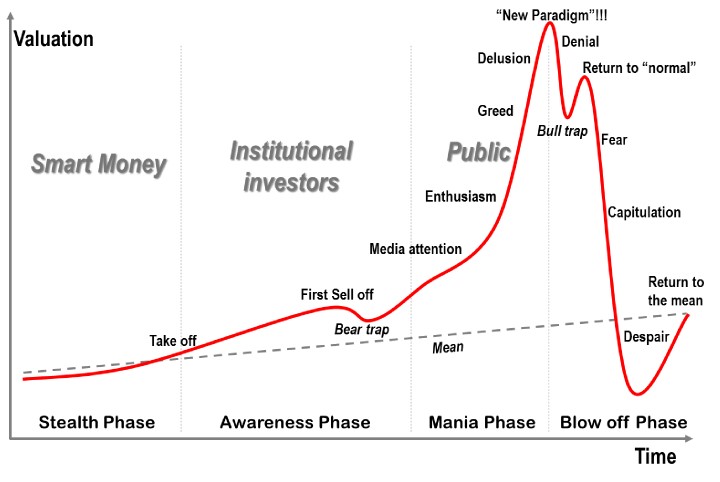

That’s an expression from the Frank Herbert science fiction trilogy, “Dune.” But it’s absolutely true. And a certain kind of client will get that right away. Here’s another illustration I like to show people:

I didn’t invent the chart. It’s a well-known illustration by Dr. Jean-Paul Rodrigue, a professor of economics at Hofstra University, though he’s given permission to use it as long as he’s credited.

It depicts all the psychological stages of the stock market boom and bust cycle.

As long as you don’t need to sell assets to raise income to live on, market volatility works for you, not against you… as long as you have the intestinal fortitude to stick with your long-term strategy, and buy the assets you need to support your retirement – now on sale at a reduced price!

This is the time to pick up your fence-sitters, and bring clients over from weak competitors. Nobody switches advisors during bull markets. They change during bear markets! They change because most advisors hide from their phone calls.

Now’s the time to put the pedal to the metal. Meet with or call every client and prospect with a simple message:

- Don’t take counsel of your fears.

- Think strategy, not short-term tactics.

- Diversify.

- Pick up great stocks while they’re on sale.

- Improve the makeup of your portfolio.

Bear markets are where the best advisors earn their keep. Anybody can look good in a bull market. The worst advisors on the planet can look good during a bull market. Heck, historically, some of them look great during big bull markets! But it’s during the bear markets you can tell who the real pros are.

Now go pick up the phone.

Watch this 3-minute video to learn how our Volatility & Bear Market Tool Kit will help you prepare yourself and expertly guide your clients through bear or volatile markets and win new business during turmoil.

Gain access to the Volatility & Bear Market Tool Kit today for $149!

6 videos. 4 audios. 11 pdf downloads and links to various resources. All the tools you need to expertly guide prospective and current clients through bear or volatile markets.