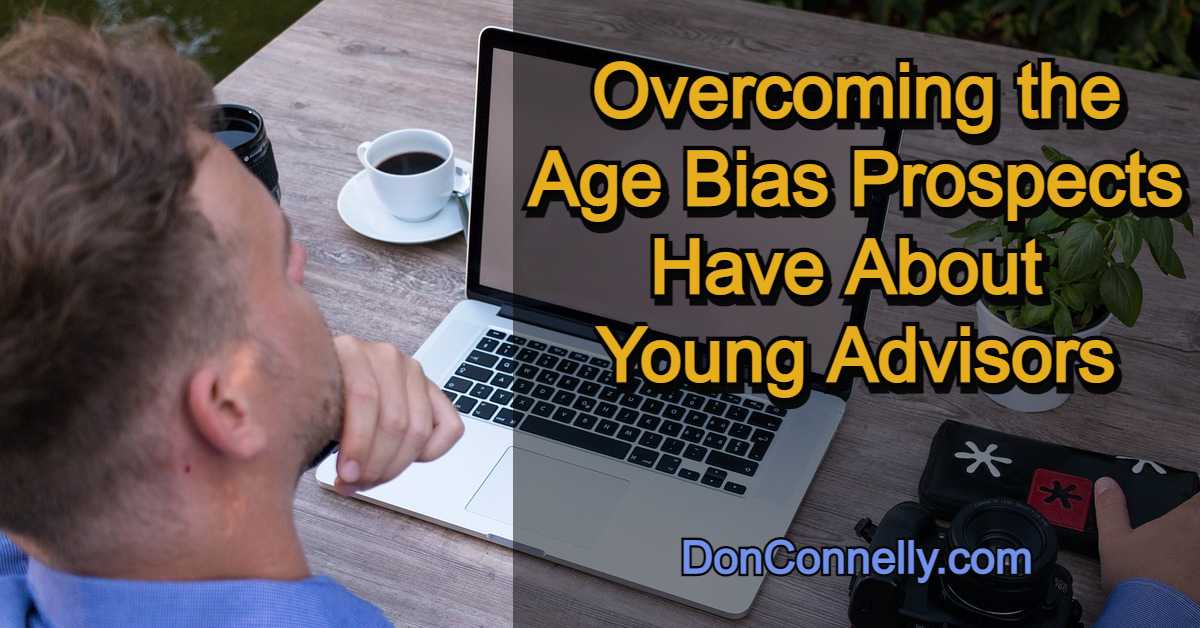

Overcoming the Age Bias Prospects Have About Young Advisors

For young financial advisors, nothing is more challenging than overcoming the age bias that older clients have against them. I hear it often from advisors who come through our training programs—that feeling as though they are viewed more like a child or grandchild than a financial advisor. It creates a perceived impression that young advisors don’t have the experience, skills, or knowledge to appreciate the circumstances of older clients, let alone guide them in making critical financial decisions.

For young financial advisors, nothing is more challenging than overcoming the age bias that older clients have against them. I hear it often from advisors who come through our training programs—that feeling as though they are viewed more like a child or grandchild than a financial advisor. It creates a perceived impression that young advisors don’t have the experience, skills, or knowledge to appreciate the circumstances of older clients, let alone guide them in making critical financial decisions.

That may be understandable and, in some cases, deserved. Older prospects are right to question a young advisor’s experience and depth of knowledge. But the problem may not be with the perceptions of older clients as much as it is with the mindset of younger advisors. Most advisors have gone through that painful period of not knowing what they need to know and feeling embarrassed to meet prospects who may sense that.

The primary difference between where they are now compared to where they were back when they knew less and lacked experience is confidence.

That feeling of being scrutinized for being young may not be due to age bias at all, but how people, young or old, react when it’s apparent you don’t have any confidence in yourself. It’s like giving off a scent that can be detected from a mile away. When you don’t have self-confidence, you implicitly communicate you don’t deserve your prospect’s confidence.

The solution then is to gain confidence in yourself so that it oozes from your pores. It can’t happen entirely overnight, but as you work towards it, you will pick up more and more confidence along the way. Here are four critical steps to becoming a confident advisor at any age.

Step #1: Educate Yourself

Competence breeds confidence. Knowledge and competence are why clients pay you. Confidence comes from knowing what you know and knowing what you don’t know. You continue your education until there is less and less of what you don’t know. In 18 to 24 months, you can earn a CFP designation, which is essential in two respects.

First, you will have completed the equivalent of a college master’s program in financial planning. Second, the designation you earn is evidence for your prospects that you are committed to advancing your knowledge. You can have confidence in speaking confidently to your prospects. But your confidence doesn’t have to wait until you earn your designation, as you will be building it along the way.

Step #2: Create a memorable first impression

When prospects meet a financial advisor for the first time, they have an expectation of what they’ll find. If you don’t meet that expectation, they might not take you seriously. If you want to present yourself as a confident financial advisor, you have to dress the part, from your hair on down to your shoes. You can have complete control over that first impression, but it may be time to make a serious investment in your wardrobe. By the way, dressing the part of a financial advisor will give you confidence that your prospects will share.

As part of that first impression, you must demonstrate you are a great communicator. Few of us are great communicators out of the box. You may have communication skills, but you probably haven’t practiced them enough. How you communicate reveals your personality, mannerisms, and professionalism—traits important to prospects. It’s how you appear older than your years.

The best investment any financial advisor can make is in learning and practicing their communication skills. Many successful advisors swear by Toastmasters International as a way to practice public speaking and refine your communication skills. People who are great communicators can tell great stories, and great storytellers exude confidence.

Step #3: Become naturally empathetic

Along the lines of communication skills but in a category of its own, is the ability to demonstrate genuine empathy. It’s how you break through barriers and build rapport. It’s how you build trust—which is essential to building a relationship. It requires proactive listening and pinpointing how your clients feel about things that are important to them. When they recognize that you recognize their feelings, a bond begins to form, and their confidence in you soars.

Masters of empathy know how to relate their clients’ feelings to a personal story in a way their clients can see themselves in that story. It’s very powerful, and the good news is you can start learning how to do that today.

Step #4: Focus on the experience of your team

You may only have a couple of years in the business, but the team around you might have dozens of years collectively. Take the initiative to explain to your prospects who is on your team, internally and externally, and the support and resources they bring to the table. Let your prospects know it’s why you chose to be a part of a team so that they can benefit from their collective years of experience.

Finally, if you ever get “you look too young to be in this business,” you can turn your youth into an advantage with “The better to serve you and your children and your grandchildren.” Clients today are thinking more and more about their legacy and how to go about securing it.

Watch this 3-minue video to learn how our program ‘Become Brilliant at the Basics: What They Teach You in Training’ can help you kick-start your practice and reach new heights by focusing on the right skills!

See program details and enroll today!

Available as a self-paced 24-ste program (always open!) or as a 12-week coaching program with LIVE session with Don Connelly (open only a few times per year) – join today to gain a significant advantage over your competition!